Deepavali gift awaits ..!

Want To Get Into The Gift Basket Business? While automobile companies are waiting to get more trade in Diwali sales to get some weight, the federal government is relying on the same Diwali season to boost the country’s economy and trade.

The country’s economy and trade market returned to normal during the Diwali festival during the first wave of corona epidemics.

As sales in most segments of the Indian automobile market have plummeted, the central government plans to reduce the excise duty on cars for the Diwali festival to boost sales in the sector.

Automobile sector

Speaking at the 61st Annual Meeting of SIAM, a consortium of automobile companies, Federal Revenue Secretary Tarun Bajaj said it was not normal to reduce car prices at present, but said the government would take necessary steps to promote car sales in the country. Could it be that offers are coming soon to boost the automobile industry? It has also caused anticipation.

Revenue Secretary Tarun Bajaj

Tarun Bajaj is also being asked to study why sales in the automobile sector have not increased. Similarly, the SUV segment is recording more sales than small cars.

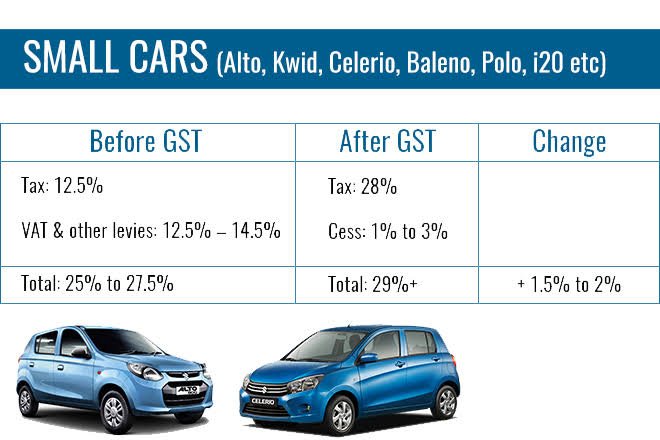

Tax on small cars

Generally only 28 per cent tax is levied on small cars, but higher taxes and extra cess are levied on SUV cars. However, Tarun Bajaj said sales of SUVs are growing.

Two wheeler division

Apart from this, Tarun Bajaj said that small price changes in the two-wheeler segment are having a big impact on the business. A senior official in the automobile sector is hopeful that the government will soon announce plans to promote sales to the federal automobile sector.

Vehicle sales volume

SIAM data shows that after the two-corona wave in India, the passenger vehicle segment traded at 2015-16, the two-wheeler segment at 2014-15, the commercial vehicle segment at 2010-11 and the three-wheeler segment at 2002-03.

Maruti Suzuki RC Bhargava

Maruti Suzuki Chairman RC Bhargava said the federal government should study the country’s economy and make decisions that will benefit the majority of the people. He said the Indian automobile market was already shifting to the electric vehicle segment and needed to make an important decision to keep the market trading.

Difference between service and freight tax

The service and freight tax in India is twice as high as in Europe, Japan and the United States. Maruti Suzuki India (MSI) President RC Bhargava has said that the question is whether it is possible to get goods at affordable prices in a country like India where the middle and poor live in large numbers.

38% tax in India

Cars purchased in India are already taxed at 8 to 9 per cent as road tax, which is already heavily taxed. As a result, cars purchased in India are taxed at an average of 37 to 38 per cent. He also questioned whether such a high tax was needed in India.

Germany, Japan

The tax on cars purchased in Germany is only 19 to 20 percent, while in Japan it is 18 to 22 percent. But in India it is taxed at 37-38 per cent. The Indian automobile industry collects Rs 1 lakh crore in GST every year. This is 12 per cent of the total tax.

Two wheeler in India

India has the largest two-wheeler segment in the world. This is not only because of the economic condition of the people but also because of the high cost of cars. Sales of luxury segment vehicles in India are also high, especially sales of vehicles over Rs 1 lakh.

More likely to reduce taxes

The Revenue Secretary also admitted that the automobile company could not reduce the price of cars at present. Thus the federal government is only likely to reduce the tax or road tax on the car if it wants to increase car sales.