As Indian banks are already facing greater vulnerabilities through Warak lending, there is increasing competition between private sector banks and public sector banks to attract trade.

In this context, the new service announced by Google, the leading tech and digital service provider in the United States, has become a major headache for Indian banks.

What kind of service has Google introduced like this ..?! Why has Google’s new service affected Indian banks so long ago ..?!

Online financial services

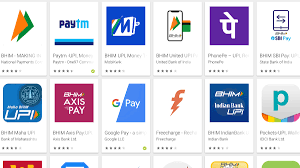

Online financial services are currently growing exponentially in India. Google’s Google Pay service is one of the 2 leading companies in India, especially in the online payment service.

Google Pay site

Google Pay has been offering a number of affiliate services over the past few years beyond the payment service. For example, credit card services, credit services, shopping site offers a wide range of services. While this may not generate large-scale business, the currently announced service has had a major impact.

One year deposit financial service

Google Pay is currently offering a new one-year deposit finance service in partnership with Equitas Small Finance Bank. You may ask what is special about it. Google Pay only offers customers higher interest income than the interest rate offered for a one-year deposit fund plan available in the Indian market.

6.85 per cent interest income

Google Pay – Equitas Small Finance Bank is currently offering a combined one-year deposit return of 6.85 per cent, with the top leading banks in India offering a one-year deposit fund with a maximum interest rate of 5.75 per cent. It offers senior citizens 0.50 percent higher interest income.

Digital and Pintech companies

Large segments of the population, especially those in their 20s and 40s, are more likely to switch to this online service platform as digital and pintech companies pay higher interest income than banks in India over time.

Fixed Deposit of Indian Banks

Banks are currently unaware of what they are doing as it affects the basic business fixed deposit scheme of Indian banks. Banks will lose more revenue if they raise interest rates to compete with Fintech companies. What banks do in this situation is ignorant.

Dominance of China

A similar situation has arisen in China, where tech and ecommerce companies dominate the day-to-day business of people, from payment to shopping, to greater reliance on pintech companies for basic credit and deposit finance services rather than banks. A similar situation is now beginning to emerge in India.

Deposit funds dominate

This deposit fund is the most important investment scheme that people trust a lot in a middle class country like India. People are more likely to use Pintech services because of the extra security of companies like Google and Amazon, even if they get a few percent extra interest.

Google Pay vs Indian Banks

Let’s take a look at what the interest situation is at other major banks in the country, with Google Pay offering an interest rate of 6.85 percent for a one-year deposit fund and 7.35 percent for senior citizens.

State Bank of India – 2.90% to 5.40%

ICICI Bank – 2.50% to 4.40%

HDFC Bank – 2.50% to 5.50%

Punjab National Bank – 2.90% to 5.25%

Canara Bank – 2.90% to 5.25%

Axis Bank – 2.50% to 5.75%

Bank of Baroda – 2.80% to 5.25%

IDFC Bank – 2.75% to 5.75%

Bank of India – 2.85% to 5.05%

Punjab and Sind Bank – 3.00% to 5.30%

Yes Bank – 3.25% to 6.50%

IndusInd Bank – 2.50% to 6.00%

UCO Bank – 2.75% to 5.00%

United Bank of India (now Punjab National Bank) – 2.90% to 5.25%

Allahabad Bank (now Indian Bank) – 2.90% to 5.15%

Central Bank – 2.75% to 5.00%

Bank of India – 2.90% to 5.15%

Indian Overseas Bank – 3.40% to 5.25%

Bandhan Bank – 3.00% to 5.00%

TBS Bank – 2.75% to 5.50%

Andhra Bank (now Union Bank) – 3.00% to 5.60%

HSBC Bank – 2.25% to 4.00%

Syndicate Bank (now Canara Bank) – 2.90% to 5.25%

Deutsche Bank – 1.80% to 6.25%

SPM Bank – 2.50% to 6.00%

Punjab and Sind Bank – 3.00% to 5.30%