It is stated that making an investment in penny shares is risky. But with the salient advantages, you need to recognise a number of the dangers as well.

Even the great groups can from time to time pass for terribly low prices. So in case you spend money on that time, it can become profitable.

However one needs to be very cautious at the same time as deciding on such penny shares. Penny shares in trendy are so low that it’s miles very smooth to shop for them. Low funding is enough. It is feasible to shop for masses of stocks in it instead of shopping for one or stocks of massive groups which have grown.

What shares

In this submit we’re going to have a take a observe groups along with Equipp Social Impact Technologies Ltd., Raghuveer Synthetics, Radhe Developers, Jindal Poly Investment & Accounting, Tata Teleservices.

Severe decline

Stock markets have visible a pointy decline and the experts are strongly claiming that this fluctuation was due to the fact the appearance of the Corona for the past 12 months. The marketplace that commenced to upward push after this is nonetheless booming today. Both the Sensex and the Nifty touched new historic highs.

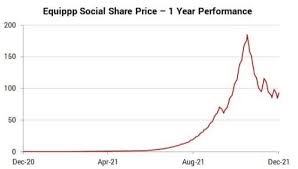

Equip Social Impact Technology

Acube Social is a joint assignment among NGOs, people and corporates. Shares of the employer have been re-indexed in February ultimate 12 months. Earlier, the inventory changed into traded below the call Proseed India. The employer went bankrupt and modified its employer and commercial enterprise model. The inventory, which traded at Rs 0.35 a 12 months ago, is presently buying and selling at Rs 93.15. It is determined at an growth of 2800%.

Raghuveer Synthetics Company

Raghuveer Synthetics is a fabric employer. It is a employer that methods many fabrics, along with cotton and polyester. The proportion fee of this employer has accelerated from 26.1 rupees to 470 rupees ultimate 12 months. It is noteworthy that there’s an growth of 1797%.

Radhe Developers Company

Radhe Developers is a actual property employer. It is positioned in Ahmedabad and Gujarat. It has accelerated from Rs 10.forty to Rs 338 withinside the ultimate six months. It has visible a 3,150% growth over this six-month period. Shares, which stood at Rs 9.1 on December 2, 2020, have now risen to Rs 309.6. This is an growth of 3,298%.

Jindal Poly Investment & Accounting

Jindal Poly Investment & Accounting is indexed as a main funding employer. It is a employer that invests in different groups. The employer’s proportion fee changed into 14.seventy five rupees and is presently buying and selling at 360 rupees. This is an growth of 2,469%.

Tata Teleservices

Tata Teleservices is an Indian telecommunications and broadband carrier issuer primarily based totally in Mumbai. It operates thru its subsidiaries, Tata Tele Business Business Services and Tata Tele Broadband. The employer’s proportion fee is presently at Rs 141.20, up from Rs 7.37% ultimate 12 months. This is visible at an growth of 1600% in a 12 months.